In a staggering turn of events, Cyngn Inc. (CYN) — a little-known autonomous vehicle and industrial robotics company — saw its stock soar over 660% on Thursday, closing at $38.14. The parabolic rise was so dramatic that trading had to be temporarily halted for volatility. But what exactly sparked this dramatic upswing? The answer lies in Nvidia’s halo effect and how a strategic association with the AI chip giant set off a firestorm of speculation.

What Triggered Cyngn’s Rally?

The rally started after Cyngn publicized a partnership or integration with Nvidia’s advanced robotics and AI platforms. Though the precise nature of the collaboration is still emerging, the market immediately responded to Cyngn’s announcement, interpreting it as a signal of legitimacy and growth potential.

Because Nvidia (NVDA) is now the world’s most valuable publicly traded company—valued at over $3.75 trillion—even a marginal affiliation with the firm can send investors into a buying frenzy. In this case, Cyngn’s use of Nvidia’s robotics processing units (RPUs) and autonomous navigation stack appears to have been enough to spark what many analysts now call a “Jensen Huang halo effect.”

What Is the Nvidia Halo Effect—and Why Does It Matter?

The term “Nvidia halo effect” refers to the irrationally strong investor reaction that small firms often enjoy when they align themselves, however loosely, with Nvidia. Given Nvidia’s dominant role in the AI chip market, its involvement is seen as a stamp of future viability, especially in fields like:

- Autonomous vehicles

- Robotics automation

- Edge computing

- AI logistics and warehousing

Because of Nvidia’s heavy push into AI robotics, particularly through its Jetson Orin platform, Omniverse, and recent humanoid robot partnerships, Cyngn’s announcement tapped directly into investor excitement around these themes.

Stock market information for Cyngn Inc (CYN)

- Cyngn Inc is an equity in the USA market.

- The price is 32.03 USD currently, with a change of 27.02 USD (5.39%) from the previous close.

- The latest open price was 16.31 USD, and the intraday volume is 81919706.

- The intraday high is 32.03 US,D and the intraday low is 4.86 USD.

- The latest trade time is Thursday, June 26, 20:11:12 +0500.

Cyngn’s Background: What Does the Company Actually Do?

While many retail traders were unfamiliar with Cyngn before the news, the company has long been involved in industrial autonomy, specifically in areas like:

- Self-driving vehicles for logistics yards and factories

- Autonomous electric forklifts and carts

- Software for robotic fleet management

- Integration with low-latency, high-performance AI chips

Cyngn’s DriveMod kit, a flagship autonomy solution, enables companies to retrofit existing fleets with autonomous driving capabilities. Although previously viewed as niche, this now looks extremely strategic, especially as Nvidia doubles down on industrial robotics.

Stock Movement by the Numbers

Cyngn opened Thursday at just $4.86 but rapidly gained attention on social platforms like X (Twitter) and StockTwits. As investor speculation snowballed, the price crossed $16, then $25, ultimately peaking over $38.14 before the market stepped in to halt trading temporarily due to circuit breaker rules.

This kind of intraday move, exceeding 300% to 600% is rare and usually reserved for biotech breakthroughs or meme stock manias. However, this surge appears to be narrative-driven, rooted in AI optimism and Nvidia’s influence.

People Also Search For: Related Stocks and Topics

As retail investors poured into CYN, searches spiked for related terms like:

- “Top Nvidia robotics partners”

- “Micro-cap stocks with AI exposure”

- “Next C3.ai or SoundHound stock”

- “Cyngn Nvidia partnership details”

- “CYN vs SoundHound”

- “Stocks using Jetson Orin”

- “AI supply chain automation”

Additionally, AI-related tickers like Symbotic (SYM), SoundHound (SOUN), and AEye Inc. (LIDR) also saw increased volume.

Can the Rally Sustain? Analyst Caution Is Rising

Despite the excitement, financial analysts have already warned that valuation has likely overshot reality. As of Thursday’s close, Cyngn’s market cap has ballooned, yet the company still reports minimal revenue and no major long-term contracts beyond pilot programs.

Moreover, unless Cyngn releases concrete revenue guidance or joint product launches with Nvidia, many traders may view this as a short squeeze or temporary hype cycle. Already, short interest in CYN has risen sharply, with options volume suggesting high volatility ahead.

The Bigger Picture: Nvidia’s Role in Robotics Expansion

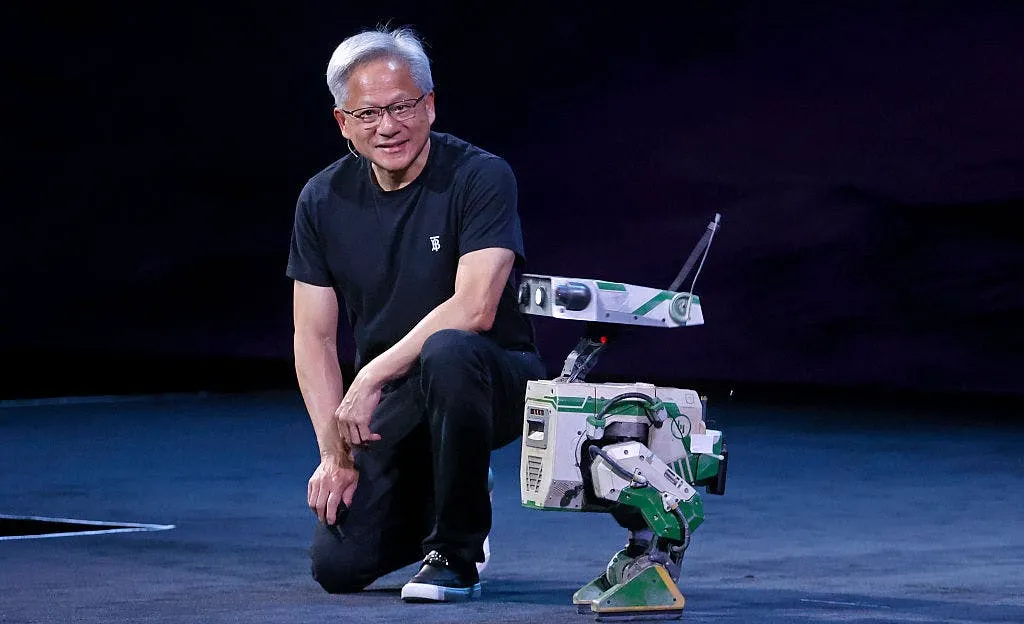

To fully understand the impact, one must consider how Nvidia has been reshaping the AI world. At the recent Computex 2025 keynote, Jensen Huang described robotics as the “physical future of AI” and laid out plans to integrate its chips into:

- Warehousing automation

- AI-powered humanoid robots (via projects like Figure.ai)

- Autonomous delivery bots

- Factory AI modeling (via Omniverse)

- AI edge inference at the industrial level

By providing both hardware (GPUs, RPUs) and software stacks, Nvidia is becoming the dominant supplier of AI infrastructure, not just in the cloud but in the physical world too.

Conclusion: What This Means for Investors and the Market

The Cyngn stock surge is more than a meme event—it’s a signal that the market is eager to reward any company riding Nvidia’s coattails, especially if robotics, automation, or generative AI is involved. However, the rally also reminds investors of the risks inherent in micro-cap trading and speculation-driven markets.

As always, due diligence is key. Investors should look for upcoming SEC filings, potential joint press releases with Nvidia, and real commercial traction before betting on sustained upside.

External Link

For a full breakdown and analyst views, visit:

👉 Barron’s on Cyngn and Nvidia Robotics Halo Effect