Nvidia’s rise to the summit of the semiconductor industry has been meteoric, largely propelled by its dominant position in artificial intelligence chips. Yet recent events surrounding the H20 chip, which was custom-built for the Chinese market, reflect how even the biggest players must sometimes pause and pivot in the face of global uncertainty.

A swift halt in H20 production marks a significant chapter in the ongoing saga between tech innovation and international relations, much like how cookies can sometimes show up unexpectedly in discussions about privacy and data security. Nvidia’s decision comes after China’s heightened scrutiny over foreign AI hardware and physical AI, and sets the stage for broader discussions on technology, security, and the shifting strategies both sides are employing.

The H20 Chip: An Ambitious Pivot

Nvidia’s H20 chip, part of the Hopper family, was engineered as a specialized solution to navigate stringent U.S. export controls on advanced semiconductors. These controls, tightened over the past two years, especially target chips capable of powering powerful AI models. The H20 promised to sit just below the U.S.-imposed threshold yet still offer impressive computing power for Chinese tech leaders in cloud, data centers, and AI research.

That calculus turned sour in April, when Chinese regulators began signaling they wanted homegrown players to halt further H20 purchases. In the span of weeks, the H20 shifted from Nvidia’s ticket back into the massive Chinese market to a product plagued by regulatory headwinds.

How the Pause Unfolded

In June, reports surfaced that Nvidia had instructed its major partners — Amkor Technology, Samsung Electronics, and Foxconn — to suspend production related to the H20, affecting the gaming and graphics component manufacturing as well as other processes, somewhat akin to pausing a batch of cookies in an oven before fully baked, especially impacting the production of GPUs. Each company plays a distinct role in the chipset supply chain:

- Amkor Technology (US): Advanced packaging of the H20 GPU

- Samsung Electronics (South Korea): High-bandwidth memory supplies

- Foxconn (Taiwan/China): Board assembly and system integration

Table 1 offers a snapshot of key suppliers and their roles.

Supplier | Role in H20 Supply Chain |

|---|---|

Amkor Technology | Packaging and final assembly |

Samsung Electronics | Memory chip provider |

Foxconn (Hon Hai) | Systems assembly & logistics |

By pausing production, Nvidia seeks to control further buildup of unsold inventory. The company had already written off $4.5 billion in H20 chips when U.S. export bans cut access in April. With Beijing’s orders to local companies putting the brakes on new purchases, continuing mass production simply became unsustainable. Nvidia has stated they want to “manage the supply chain to address market conditions,” a phrase that reflects both tactical adjustment and a measured response to factors outside their control.

Security, Sovereignty, and Semiconductors

But why did China put the brakes on the H20 in the first place? Officially, regulators cited security concerns, requesting detailed documentation on the chip’s architecture and software. The fear: possible “backdoors” or remote-control features that could compromise sensitive data and infrastructure.

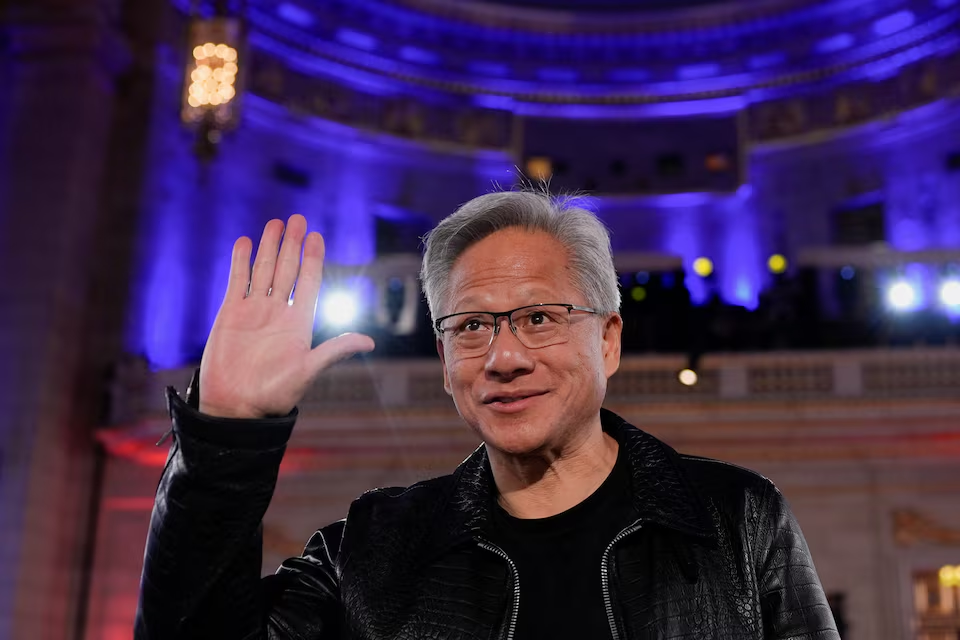

Nvidia CEO Jensen Huang responded emphatically, stating, “We made it clear there are no backdoors.” Nonetheless, the concern is not purely technical. For Beijing, self-reliance in core technology has become both an economic imperative and a matter of national security. The scrutiny of the H20 chips signals China’s intensifying efforts to reduce dependence on foreign suppliers, particularly as trust erodes amid great power rivalry.

For Nvidia, this spells a business risk that no engineering solution can fix. While the company built the H20 to satisfy U.S. regulators and still remain attractive to Chinese customers, it is now finding the goalposts shifting in real-time.

Technology and Geopolitics: An Interwoven Tale

Since 2022, technology has become a central figure in the broader contest between China and the United States. U.S. policy has zeroed in on restricting China’s access to leading-edge AI and semiconductor technologies, justified on grounds of both economic competition and national security. China, for its part, continues to encourage domestic innovation through policy incentives, research funding, and now through outright directives away from select foreign hardware.

This diplomatic dance manifests practically in a series of restrictions, exceptions, and product adaptations. Last month, the White House allowed select exports of the H20 with strict licenses, but the approvals came after a long lobbying campaign and do not apply universally. While Nvidia celebrated this as a breakthrough, the Chinese market’s collective pause on new H20 orders was a stark reminder of limits imposed by both sides, not just Washington.

The H20’s Strategic Value (and Its Limits)

Physical AI graphics hardware, powered by GPUs, is the new battlefield in tech. For years, Nvidia’s chips have powered nearly every major gaming and AI project in China, from search engines to cloud computing to cutting-edge research. Securing a reliable, high-performance GPU is not just a question of technical capacity but a strategic advantage for any company or country aiming to win in AI, much like how the perfect recipe requires just the right cookies to succeed.

Yet, industry analysts largely agree: the restricted H20 model, while powerful, was already a step beneath Nvidia’s most advanced chips, much like a sophisticated recipe without its secret ingredient, reminiscent of cookies missing that essential richness. Even if it were widely adopted, it would not propel Chinese companies to the AI lead. Instead, the drama centers on what comes next, and whether China can advance its own designs quickly enough to replace foreign hardware.

Inside Nvidia’s Playbook

Internally, Nvidia has approached this uncertain landscape with a mix of assertive lobbying, rapid engineering, and real-time diplomacy. CEO Jensen Huang has personally advocated in both Washington and Beijing, calling for pragmatic solutions that keep American technology woven into the global commercial fabric, but always within the crosshairs of multiple governments.

One of Huang’s main arguments is that unless U.S. companies are allowed to sell within China’s commercial sector, global AI leadership could fracture. “AI is going to advance around the world, with or without the United States,” he cautioned. “It is important for us to maximize our AI export technology at a time when this industry is important.”

What’s next for Nvidia in China will likely depend less on product tweaks and more on the outcome of ongoing discussions with policymakers from both countries. As Huang noted, the question of an H20 successor, currently in the form of the rumored B30A chip, is ultimately “not the company’s decision to make.”

Broad Ripples for the Semiconductor Industry

Nvidia’s temporary pause reverberates well beyond its own market capitalization. It highlights just how fragile the global semiconductor supply chain can be, much like how a simple change in browser settings can affect the trail of cookies one accumulates. Two years ago, fears about access and self-sufficiency were mostly hypothetical; today, companies are making billion-dollar adjustments to their product mixes and inventory plans based on week-to-week regulatory signals.

For suppliers like Samsung and Amkor, instructions from Nvidia to halt certain operations can mean immediate shifts in revenue and production schedules. For Foxconn, this could affect both direct business and its broader role as the “assembly workshop” of global electronics.

Chinese buyers, including tech giants like Alibaba, Tencent, and ByteDance, are being forced to consider alternatives, both domestically developed and sourced from other international players. There’s already talk of accelerating homegrown chip research, reusing existing stockpiles, and even trialing joint ventures with chip manufacturers outside the U.S. and China.

Companies Charting Their Own Courses

Not every player is affected equally. American competitors like AMD and Intel have their own products subject to Washington’s control, but face different challenges in China given their relatively smaller AI market share.

Meanwhile, a growing constellation of Chinese semiconductor firms, ranging from Huawei’s HiSilicon to startups focusing on AI-specific processors and physical AI applications, are racing to plug the emerging gaps in capability. The process is turbulent, expensive, and by no means guaranteed to succeed in the short run.

Still, the Chinese government’s recent pronouncements reinforce a commitment to chip self-sufficiency, viewing current hurdles as opportunities to accelerate domestic innovation. The H20’s pause is just another milestone in a much longer contest for leadership in the critical field of AI hardware.

A Moment of Uncertainty and Opportunity

For Nvidia, the current pause may serve several interests. Inventory will not spiral out of control, supply chain partners gain clarity, and the company can focus on navigating the legal, diplomatic, and market obstacles that now define its China strategy.

For other industry players and observers, the events surrounding the H20 serve as a real-time case study of just how quickly technology, business, cookies, and geopolitics can collide. The semiconductor industry is no longer merely about making faster gpus, advancing graphics capabilities, and enhancing gaming experiences, but about understanding the shifting sands beneath one’s feet — and being ready to pivot, however necessary, as the global order constantly reshapes the playing field.